The stock market is a dynamic world where fortunes are made, strategies are tested, and dreams of financial independence are pursued. If you’re considering entering the stock market, understanding its mechanisms, risks, and opportunities is key to success.

In this blog, we’ll talk about the stock market by exploring how it works, why people invest, and tips for navigating the buying and selling of shares in publicly traded companies to maximize potential returns.

What Is the Stock Market?

The stock market is a marketplace where investors buy and sell shares of publicly traded companies. Shares, or stocks, represent partial ownership of a company. When you own a share, you own a piece of that company—and with it, the opportunity to benefit from its growth and profitability.

Why Invest in the Stock Market?

1. Wealth Generation

Historically, the stock market has provided higher returns over the long term compared to other investment options like bonds or savings accounts.

2. Ownership and Dividends

Owning shares allows you to benefit from a company’s success. Some companies pay dividends—regular cash payouts—as a share of their profits.

3. Liquidity

Stocks are relatively liquid, meaning you can buy or sell them quickly compared to other investments like real estate.

4. Diversification

The stock market offers access to a wide range of industries and sectors, enabling investors to diversify and reduce risk.

5. Beat Inflation

Over time, the stock market has outpaced inflation, helping investors maintain or grow their purchasing power.

How the Stock Market Works

1. Publicly Traded Companies

When a company wants to raise funds for growth, it may issue shares through an Initial Public Offering (IPO), making them available to the public.

2. Stock Exchanges

Shares are traded on stock exchanges, such as the New York Stock Exchange (NYSE) or NASDAQ. Buyers and sellers interact through brokers or trading platforms.

3. Supply and Demand

Stock prices fluctuate based on supply and demand. If more people want to buy a stock (high demand), its price goes up. If more want to sell (high supply), the price goes down.

4. Market Participants

The market consists of individual investors, institutional investors, traders, and market makers. Each plays a role in keeping the market liquid and functional.

Steps to Buy and Sell Stocks

1. Open a Brokerage Account

Choose a brokerage firm, such as Fidelity, E*TRADE, or Robinhood. Opening an account is your gateway to buying and selling shares.

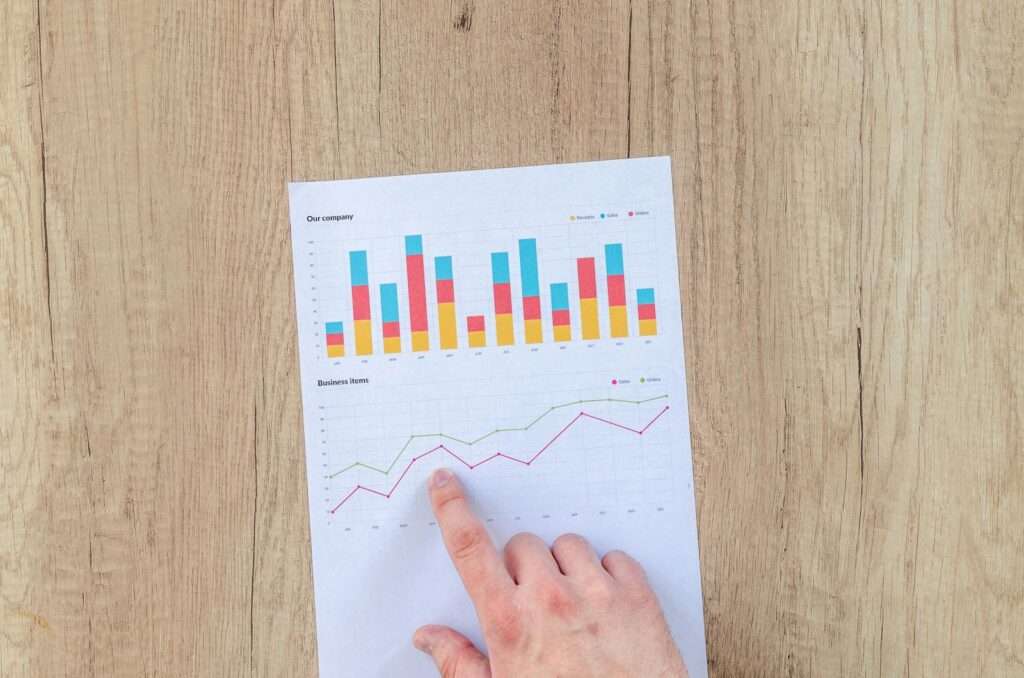

2. Research Stocks

Analyze companies using financial statements, industry trends, and market performance. Look at factors like revenue growth, profitability, and leadership.

3. Decide What to Buy

You can buy individual stocks, exchange-traded funds (ETFs), or mutual funds, depending on your risk tolerance and goals.

4. Place an Order

There are two main types of orders:

- Market Order: Buy or sell immediately at the current price.

- Limit Order: Set a specific price at which you want to buy or sell.

5. Monitor Your Investments

Keep track of your portfolio and market trends. Adjust your holdings based on performance and goals.

6. Selling Shares

When it’s time to sell, choose a strategy—sell to lock in profits, cut losses, or rebalance your portfolio.

Types of Stock Market Investments

1. Common Stocks

These are the most common type of stock. Owners have voting rights and may receive dividends.

2. Preferred Stocks

Preferred stockholders get priority for dividends but usually don’t have voting rights.

3. ETFs and Index Funds

These funds track the performance of an index like the S&P 500, offering diversification without picking individual stocks.

4. Dividend Stocks

These stocks provide regular income through dividends, making them ideal for investors seeking steady cash flow.

5. Growth Stocks

These are shares in companies expected to grow faster than the market average, often reinvesting profits instead of paying dividends.

Understanding Risk and Reward

1. Market Volatility

Stock prices can fluctuate due to economic, political, or company-specific events.

Tip: Stay focused on long-term goals to ride out short-term volatility.

2. Risk Tolerance

Assess how much risk you’re comfortable with based on your financial goals and timeline.

3. Diversification

Don’t put all your eggs in one basket. Spread your investments across different sectors and asset types.

4. Emotional Discipline

Avoid panic selling during market downturns. Successful investing requires patience and a cool head.

Strategies for Generating Returns

1. Long-Term Investing

Buy and hold quality stocks for years to benefit from compound growth. This strategy minimizes trading fees and capitalizes on market trends over time.

2. Dividend Investing

Focus on companies with a track record of paying consistent and growing dividends.

3. Growth Investing

Invest in companies with high potential for revenue and profit growth.

4. Value Investing

Look for undervalued stocks with strong fundamentals that the market has overlooked.

5. Day Trading and Swing Trading

These short-term strategies aim to capitalize on small price movements. They require experience, research, and time commitment.

Tips for Beginners

1. Start Small

Invest only what you can afford to lose while you’re learning the ropes.

2. Educate Yourself

Read books, take courses, and follow market news to build your knowledge.

3. Focus on the Basics

Stick to simple strategies and avoid speculative investments early on.

4. Automate Investments

Use automatic contributions to invest consistently, regardless of market conditions.

5. Be Patient

The stock market rewards patience. Avoid trying to time the market.

Potential Pitfalls to Avoid

1. Chasing Hot Stocks

Investing based on trends or hype often leads to disappointment. Do your research.

2. Ignoring Fees

Trading fees, account fees, and taxes can eat into your returns. Choose a cost-effective broker and be tax-aware.

3. Emotional Decisions

Fear and greed can lead to buying high and selling low. Stick to your strategy.

4. Lack of Diversification

Over-investing in one stock or sector increases risk. Diversify to protect your portfolio.

The Bottom Line

Investing in the stock market offers an exciting opportunity to grow your wealth, but it requires knowledge, discipline, and a clear strategy. By understanding the basics of buying and selling shares, managing risk, and sticking to long-term goals, you can navigate the stock market with confidence.

Remember, there’s no guaranteed way to eliminate risk, but with patience and informed decision-making, you can position yourself for potential success.